This post was featured on Seeking Alpha December 9th, 2016.

Summary

- After speaking with Saratoga’s CFO earlier this week, we believe this BDC’s 9.2% dividend yield is healthy, and the company has lots of dry powder for continued growth.

- Despite Saratoga’s recent strong price appreciation year-to-date, it still enjoys an attractive valuation, several important competitive advantages, and less exposure to the big risks facing the BDC industry.

- According to Saratoga’s CFO, Henri Steenkamp, “We’re not afraid to not grow in a quarter, our most important thing is not to sacrifice credit quality”.

After speaking with the Chief Financial Officer (Henri Steenkamp) of Saratoga Investment Corp. (NYSE:SAR) for 40 minutes earlier this week, our main takeaway is that the 9.2% dividend yield of this small cap Business Development Company (BDC) is healthy (with room to grow) because the company continues to enjoy an attractive valuation (even after the shares’ strong rally so far this year), several important competitive advantages (for example, access to plenty of low-cost capital, aka “dry powder”), and may actually be less impacted by some of the big risks facing the BDC industry as a whole.

Overview

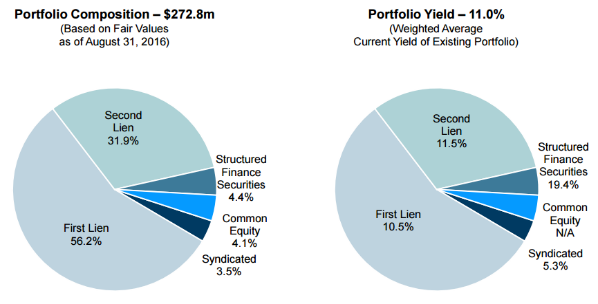

Saratoga Investment Corp. is a publicly traded BDC providing financing solutions to lower middle market companies through its SBIC-licensed subsidiary and a $300 million Collateralized Loan Obligation (CLO) fund. As the following chart shows, Saratoga’s portfolio is composed mainly of first and second liens, and the yields on these financing arrangements are significant (this is how Saratoga supports its healthy dividend).