Summary

-

This article discusses why I believe BDCs don’t need to sacrifice credit quality when increasing their asset base, as evidenced by Saratoga Investment Corp.’s continued out-performance in Q3 of fiscal 2016 and throughout fiscal 2016.

-

By maintaining quality and other key pillars, a BDC can maintain a high quality asset base with a strong yield and return on equity.

-

A BDC can see additional potential by maintaining a strong liquid base for future funding while looking for promising investments.

Over Q1 and Q2, Saratoga Investment Corp. has been able to boast an impressive record of growth leading to increased financial performance. For Q3, including our deals that closed shortly after quarter-end we did much of the same. During that time, Saratoga’s success has been accomplished by a disciplined focus on various milestones and objectives that I believe all BDCs can use as a roadmap for their company.

Along with Chief Executive Officer Christian Oberbeck and Chief Investment Officer Mike Grisius, Saratoga built upon its already growing momentum from the previous year by reviewing and staying true to our primary focus and long-term objective during the last five years–which is to increase the quality and size of our asset portfolio base with the ultimate purpose of building Saratoga Investment Corp. into a best-in-class BDC, generating meaningful returns for our shareholders. By maintaining that focus while seeking areas of additional improvement, we continued our momentum gained during the first two fiscal quarters and last year towards realizing our long-term strategic objectives. Highlights from just the past quarter include:

-

Consistent originations sustain assets under management amongst significant redemptions.

-

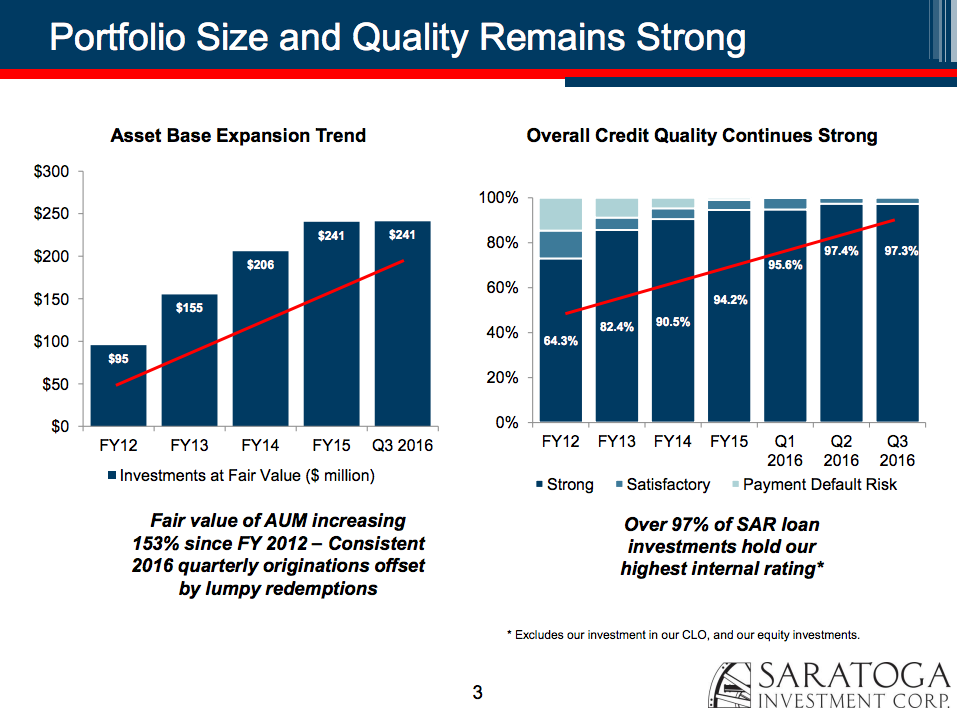

Total AUM up 153% from FY12.

-

Since quarter-end, new originations of $31.2 million with minimal redemptions.

-

-

Continued improvements in key performance metrics.

-

NAV increased 1.6% to $127.3 million.

-

Investment quality at strongest level ever. Over 97% of loan investments with highest rating.

-

Return on equity of 10.8% for Q3 and 12.9% YTD, beating industry average of 4.3%.

-

-

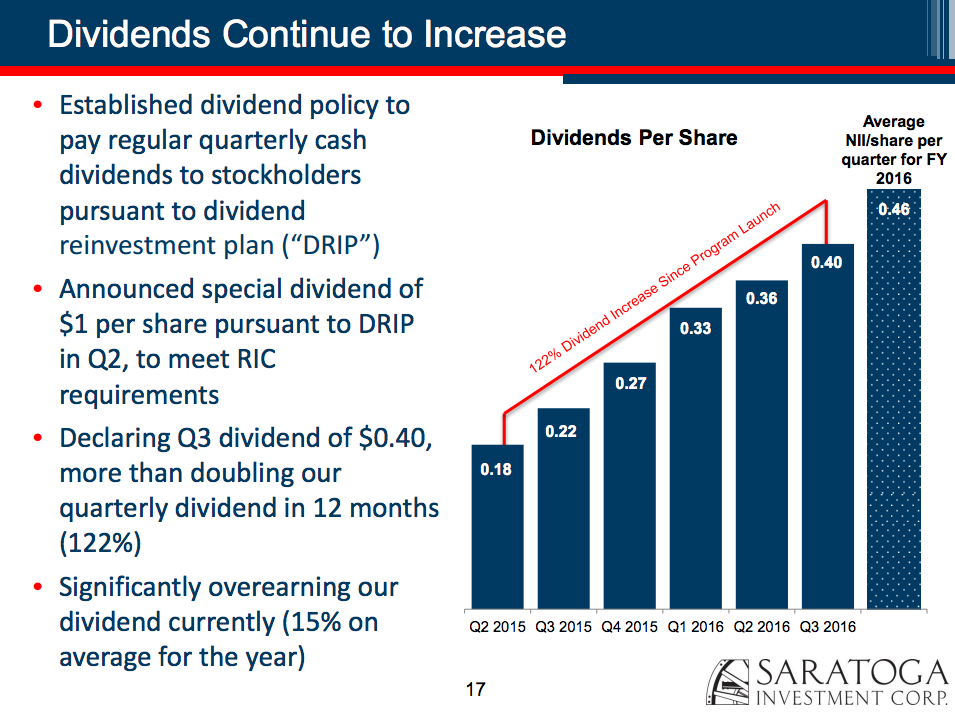

Declared new dividend of $0.40 per share continuing increase in quarterly dividends, more than doubling our quarterly dividends in past 12 months.

-

Represents dividend for quarter ended November 30, 2015, payable on February 29, 2016 for all stockholders of record on February 1, 2016.

-

When it comes to other BDCs striving for similar goals, achieving success is built on certain fundamental objectives:

Maintain a robust high quality asset base, with strong yield and return on equity:

As we grow our portfolio asset base and generate competitive yields, we’ve done so with a continued focus on the quality of our portfolio.

Despite an unusual industry-wide concentration of redemptions, Saratoga’s metrics held strong on a quarter-over-quarter basis. This is in large part due to our endeavors to maintain a robust, quality asset base that offered portfolio diversity through various industries, as well as strong yields and return on equity. This holds true with Saratoga’s simple and consistent objectives.

In thinking both short and long-term, executing our strategy requires expansion without sacrificing credit while benefiting from scale. Crucially, we are seeing more deals by growing our pipeline. This is done by internally adding to our management team and capabilities thereby providing Saratoga the best possibility to increase our capacity in a thoroughly researched and repeatable way.

As evidenced by the graph below when combined with the new originations subsequent to quarter-end as previously maintained., we have been growing consistently and expect the coming quarters to indicate a further net portfolio growth–a growth that would not be possible without sticking to the plan. And this growth has taken place while continuing to maintain an extremely high credit quality:

Overall Strengthening of a BDCs Foundation Enables Continued Increases in Cash Dividends.

With a current quarterly dividend yield of 10.7%, Saratoga more than doubled its regular quarterly cash dividend in the past 12 months. Shareholders can also continue to participate in our dividend reinvestment plan, if they elect to opt in.

Our strengthened foundation and DRIP program allows the opportunity for shareholders to reinvest dividend in our stock, which is trading below NAV while at the same time being in a growth phase.

Maintain a Strong Liquidity Base, Look for Promises of Improvement

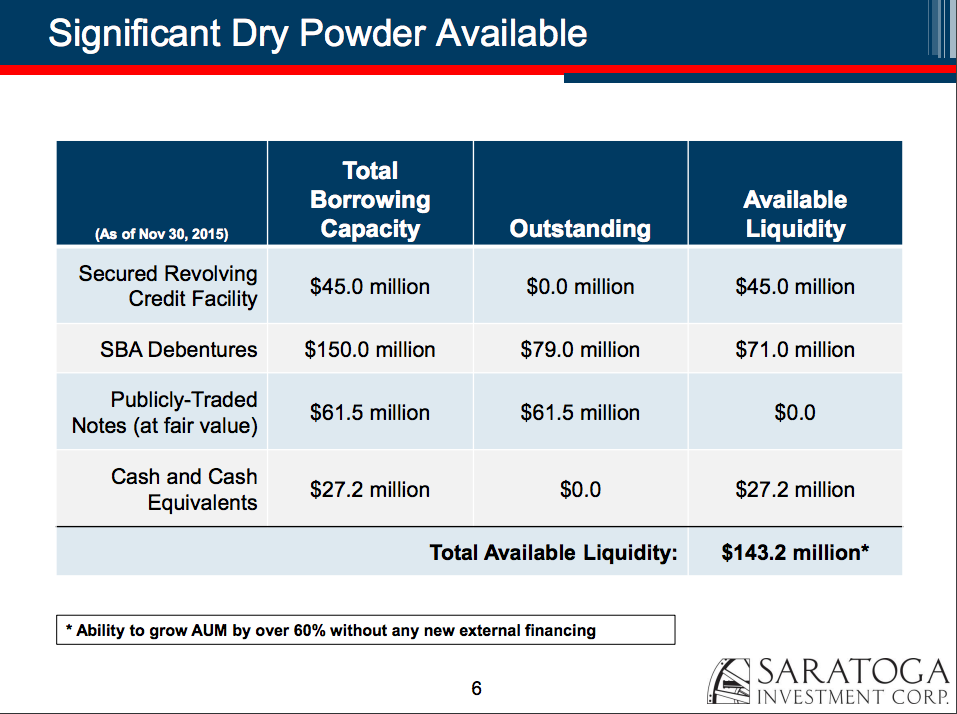

Saratoga is in the midst of obtaining its second SBIC license. On April 2, 2015 Saratoga was given its green light and go forth letter from the SBA. If approved, the license allows for Saratoga to grow its assets by at least $112.5 million. Additionally on May 29 2015, Saratoga entered into a Debt Distribution Agreement with Ladenburg Thalmann. By entering into the agreement, Saratoga can offer first sale from time to time up to $20 million in aggregate principal amount of our existing Baby Bonds issuance through an at the market offering. Since the agreement was struck and through the end of Q3, Saratoga sold bonds with a principal of $13.1 million with an average percent premium of 1.2.

Furthermore, with our Board of Directors extending our share repurchase program, Saratoga can repurchase up to 400,000 shares of its common stock up to October 2016. During Q2, Saratoga repurchased 2,500 shares.

By keeping a strong liquidity base while expanding into other areas of improvement, a BDC strategically places itself in an area of stability and improvement. Our available dry powder at the conclusion of Q3–consisting of SBA debentures, our secured revolving credit facility, and cash and cash equivalents–gives Saratoga the ability to grow AUM by over 60% without any new external financing (see below).

While these pillars might need adjusting to fit a particular BDC, a strong foundation built on a consistent vision of quality while exploring future growth opportunities should translate positively to all companies.

Disclosure: I am/we are long SAR.