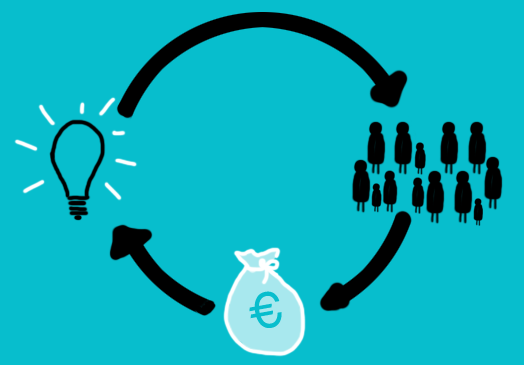

The rise of crowdfunding has allowed for emerging entrepreneurs and businesses an entirely new avenue to gain funds for their venture. For these aspiring business leaders, one successful round of funding can take their promising plan into a viable business with ample revenue to work with. Those looking to go the crowdfunding route have numerous credible platforms to choose from. A quick Google search will come back with names like Kickstarter, Indiegogo and GoFundMe as starters.

For some with less experience in the fundraising realm may think that crowdfunding is comparable to BDC investing. However, just because your business is viable for one potential form of fundraising, it doesn’t mean you are qualified for the other. If you find yourself uncertain of which path fits your business better, consider the characteristics.

When it comes to crowdfunding, a business that is ready to move forward has a couple of characteristics laid out in their business. Consider it a part of their identity. This portion of its business identity reflects its competency, consistency and foresight. Regardless of company ethos, traits like a goal-oriented vision indicate that your business is ready to raise upwards of millions of dollars–and you know how to use it. But you don’t succeed merely on goals. A viable crowdfunding business also has a plan. This plan incorporates your targeted fundraising goal and how each cent goes into the business.

Is your business a lone wolf? Do you lack a network? If so, consider expanding your network before going forward with fundraising. A solid network not only increases your chances of having a successful fundraising campaign, it provides you with a reliable network of like-minded individuals in similar scenarios as you are. This increases your marketability, which is integral in getting the word out about your campaign.

Whether you are a newcomer or a seasoned veteran to crowdfunding, these four characteristics serve as a solid foundation for building your campaign upon.

Going with a business development corporation is a bit of a different route. Additionally, the BDC may choose to not go down that route with you. That’s because while BDCs support the ambitions of crowdfunded ventures, they look for more of an established track record before committing to a new portfolio company. For a business with a successful round of funding under its belt, they may want to consider a BDC at that point.

These companies embrace the same methodology of a successful crowdfunding campaign, but it also requires intangibles that mirror almost any relationship in life. BDCs thrive on healthy relationships, where crowdfunding depends less on this quality. With quite a bit of communication between a BDC and a portfolio company, communication must be open and healthy.

Consistent communication is just one facet of consistency that an ideal portfolio company possesses. That consistency extends to a company’s performance when it comes to managing risk, staff and a key statistic, the bottom line. If a potential portfolio company fails to demonstrate its consistency, there is a high probability that most BDCs will elect not to pursue your company at this time. Additionally, there is the “secret sauce” of BDC investing. The secret sauce is the ideal candidate–revenue between $8 million and $150 million, most likely privately held and have significant capital needs that bank loans cannot satisfy.

If your business falls in line with the above criteria, now may be the time to explore becoming a portfolio company. Regardless of the decision you choose, this should be a meticulously explored venture. Making the wrong choice can harm your financial, and potentially, industry standing. Both routes require extensive analysis, risk assessment and internal inquiry. If all these traits begin to highlight your business, it may be time for you to take the next step in this process.