NEW YORK, July 10, 2019 (GLOBE NEWSWIRE) — Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced financial results for its 2020 fiscal first quarter.

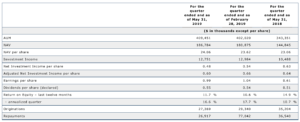

Summary Financial Information

The Company’s summarized financial information is as follows:

“Highlights from our fiscal 2020 first quarter include LTM return on equity of 11.7%, an increase in NAV per share of $0.44 to $24.06, and adjusted NII per share of $0.60,” said Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment. “These results have been achieved while we continue to strengthen our organizational and capital foundation and grow our high quality asset base. Important differentiating metrics include dividend coverage – our adjusted NII per share of $0.60 is five cents above our current $0.55 dividend; relative performance – LTM ROE of 11.7% is almost 300 basis points above the BDC industry mean; and NAV growth – NAV per share of $24.06 is up 4.3% from the same period last year. Last month, we also increased our dividend for the nineteenth consecutive quarter, a $0.01 increase to $0.55 per share. Our management team continues to generate outperformance despite increasingly challenging market conditions.”

Michael J. Grisius, President and Chief Investment Officer, added, “This fiscal quarter has again demonstrated our ability to steadily build AUM without sacrificing quality, despite a borrower-friendly environment that has made this difficult to accomplish. Our capital deployed this quarter matched our redemptions, which continue to be lumpy and difficult to predict, and importantly, the portfolio investments rated in our highest category remained at a very high 99%. We also continue to increase our investments in new platforms, with three more investments in new portfolio companies added this quarter, and one more since quarter-end. Despite growing market headwinds, we remain confident that we can steadily improve portfolio size and maintain quality over the long-term by remaining true to our disciplined investment approach, exceptional underwriting standards and the long-term strategy and focus that has guided us since taking over management of the BDC.”

As of May 31, 2019, Saratoga Investment increased its assets under management (“AUM”) to $409.5 million, an increase of 1.8% from $402.0 million as of February 28, 2019, and an increase of 19.2% from $343.4 million as of May 31, 2018. The increase this quarter consists of originations of $27.4 million offset by repayments and amortizations of $26.9 million, with the bulk of the quarterly increase reflecting unrealized appreciation. Including realized and unrealized gains, Saratoga Investment’s portfolio has continued to grow this quarter and remains strong, with a continued high level of investment quality in loan investments, with 98.7% of its loans this quarter at its highest internal rating. Included in this quarter’s originations are also three investments in new portfolio companies. Since Saratoga Investment has taken over the management of the BDC, $375.7 million of repayments and sales of investments originated by Saratoga have generated a gross unlevered IRR of 13.9%.

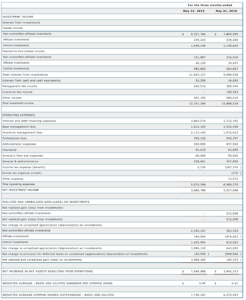

For the three months ended May 31, 2019, total investment income of $12.8 million increased $2.3 million, or 21.6%, compared to $10.5 millionfor the three months ended May 31, 2018. This increased investment income was generated from an investment base that has grown by 19.2% since last year. In addition, the benefit of an increase in interest earned on CLO equity was partially offset by the weighted average current coupon on non-CLO BDC investments decreasing from 11.3% to 10.8%. In addition, this quarter’s investment income was down 1.8% on a quarter-on-quarter basis from $13.0 million for the quarter ended February 28, 2019.

As compared to the three months ended May 31, 2018, the investment income increase of $2.3 million was offset by: (i) increased debt and financing expenses, as the growth in AUM this year was partially financed from increased SBA debentures and the $60.0 million baby bond issuance last year; (ii) increased base and incentive management fees generated from the management of this larger pool of investments; and (iii) the non-recurrence of the $0.3 million income tax benefit generated last year from net operating losses in Saratoga Investment’s blocker subsidiaries. Total expenses, excluding interest and debt financing expenses, base management fees and incentive fees and income tax benefit, reduced from $1.5 million for the three months ended May 31, 2018 to $1.3 million for the three months ended May 31, 2019.

Net investment income on a weighted average per share basis was $0.48 for the quarter ended May 31, 2019. Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income on a weighted average per share basis was $0.60. This compares to adjusted net investment income per share of $0.66 for the quarter ended February 28, 2019, and $0.64 for the quarter ended May 31, 2018, reflecting decreases of $0.06 per share and $0.04 per share, respectively. During these periods, weighted average common shares outstanding increased from 6.3 million shares for the three months ended May 31, 2018, to 7.5 million shares and 7.7 million shares for the three months ended February 28, 2019 and May 31, 2019, respectively.

Net investment income yield as a percentage of average net asset value (“Net Investment Income Yield”) was 8.0% for the quarter ended May 31, 2019. Adjusted for the incentive fee accrual related to net unrealized capital gains, the Net Investment Income Yield was 10.1%. In comparison, adjusted Net Investment Income Yield was 11.2% and 11.1% for the quarters ended February 28, 2019 and May 31, 2018, respectively.

Net Asset Value (“NAV”) was $186.8 million as of May 31, 2019, an increase of $5.9 million from $180.9 million as of February 28, 2019, and an increase of $42.0 million from $144.8 million as of May 31, 2018.

- For the three months ended May 31, 2019, $3.7 million of net investment income and $4.0 million of net unrealized appreciation were earned, partially offset by $0.02 million deferred tax expense on net unrealized gains in Saratoga Investment’s blocker subsidiaries and $4.2 million of dividends declared. In addition, $0.7 million of stock dividend distributions were made through the Company’s dividend reinvestment plan (“DRIP”), and 76,448 shares were sold through the Company’s At-the-Market (“ATM”) equity offering during the quarter.

NAV per share was $24.06 as of May 31, 2019, compared to $23.62 as of February 28, 2019, and $23.06 as of May 31, 2018.

- For the three months ended May 31, 2019, NAV per share increased by $0.44 per share, primarily reflecting the $3.5 million, or $0.45 per share increase in net assets (net of the $0.54 dividend paid during the first fiscal quarter of 2020). This was slightly offset by the $0.01dilutive impact of the quarter’s 107,688 share issuances from the DRIP and ATM programs. The Company made no purchases of common stock in the open market during the quarter.

Return on equity for the last twelve months ended May 31, 2019, was 11.7%, compared to 14.9% for the comparable period last year.

Earnings per share for the quarter ended May 31, 2019, was $0.99, compared to earnings per share of $1.04 for the quarter ended February 28, 2019, and $0.61 for the quarter ended May 31, 2018.

Investment portfolio activity for the quarter ended May 31, 2019:

- Cost of investments made during the period: $27.4 million, including investments in three new portfolio companies

- Principal repayments during the period: $26.9 million

Additional Financial Information

For the fiscal quarter ended May 31, 2019, Saratoga Investment reported net investment income of $3.7 million, or $0.48 on a weighted average per share basis, and a net realized and unrealized gain on investments of $4.0 million, or $0.51 on a weighted average per share basis, resulting in a net increase in net assets from operations of $7.6 million, or $0.99 on a weighted average per share basis. The $4.0 million net gain on investments was comprised entirely of $4.0 million in net unrealized appreciation on investments, offset slightly by $0.02 million of net deferred tax expense on unrealized gains in Saratoga Investment’s blocker subsidiaries.

The $4.0 million unrealized appreciation primarily reflects (i) $1.6 million unrealized appreciation on the Company’s Censis Technologies investment, (ii) $1.2 million unrealized appreciation on the Company’s Flywheel investment that was realized subsequent to quarter-end, (iii) $1.2 million unrealized appreciation on Saratoga’s CLO equity investment, reflecting first quarter performance exceeding projections, and (iv) $0.8 million unrealized appreciation on the Company’s Ohio Medical investment reflecting improved performance. This was offset primarily by $0.7 million unrealized depreciation on the Company’s My Alarm Center investment. This is compared to the fiscal quarter ended May 31, 2018, with net investment income of $3.9 million, or $0.63 on a weighted average per share basis, and a net realized and unrealized loss on investments of $0.09 million, or $0.01 on a weighted average per share basis, resulting in a net increase in net assets from operations of $3.8 million, or $0.61 on a weighted average per share basis. The $0.09 million net loss on investments consisted of $0.2 million in net realized gains on investments and $0.6 million in unrealized appreciation, offset by $0.9 million in net deferred tax expense on unrealized gains in Saratoga Investment’s blocker subsidiaries.

Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income was $4.6 million and $4.0 million for the quarters ended May 31, 2019, and May 31, 2018, respectively – an increase of $0.6 million year-over-year, or 15.9%.

Total expenses, excluding interest and debt financing expenses, base management fees and incentive management fees, increased from $1.2 million for the quarter ended May 31, 2018, to $1.3 million for the quarter ended May 31, 2019, but decreased from 1.4% to 1.1% of average total assets.

Portfolio and Investment Activity

As of May 31, 2019, the fair value of Saratoga Investment’s portfolio was $409.5 million (excluding $61.0 million in cash and cash equivalents), principally invested in 33 portfolio companies and one collateralized loan obligation fund (“CLO”). The overall portfolio composition consisted of 53.6% of first lien term loans, 26.7% of second lien term loans, 0.5% of unsecured term loans, 9.3% of subordinated notes in a CLO and 9.9% of common equity.

For the fiscal quarter ended May 31, 2019, Saratoga Investment invested $27.4 million in new or existing portfolio companies and had $26.9 million in aggregate amount of exits and repayments, resulting in net investments of $0.5 million for the quarter.

As of May 31, 2019, the weighted average current yield on Saratoga Investment’s portfolio for the twelve months ended was 10.6%, which was comprised of a weighted average current yield of 10.7% on first lien term loans, 11.8% on second lien term loans, 0.0% on unsecured term loans, 16.0% on CLO subordinated notes and 2.8% on equity interests.

Liquidity and Capital Resources

As of May 31, 2019, Saratoga Investment had no outstanding borrowings under its $45 million senior secured revolving credit facility with Madison Capital Funding LLC. At the same time, Saratoga Investment had $150.0 million SBA debentures outstanding, $134.5 million of baby bonds (fair value of $137.5 million) issued and an aggregate of $61.0 million in cash and cash equivalents.

With $45.0 million available under the credit facility and the $61.0 million of cash and cash equivalents, Saratoga Investment has a total of $107.1 million of undrawn borrowing capacity and cash and cash equivalents available as of May 31, 2019. This would allow Saratoga Investment to grow current AUM by 26% without any new external financing. The net proceeds from the DRIP and ATM equity program totaled $2.4 million of equity issuances for the quarter ended May 31, 2019. Saratoga Investment also has the ability to issue additional equity or baby bonds through the existing shelf registration statement.

On March 16, 2017, Saratoga Investment entered into an equity distribution agreement with Ladenburg Thalmann & Co. Inc., through which Saratoga may offer for sale, from time to time, up to $30.0 million of its common stock through an ATM offering. Subsequent to this, BB&T Capital Markets and B. Riley FBR, Inc were also added to the agreement. On July 9, 2019, the amount of common stock to be offered through this offering was increased to $70.0 million. As of May 31, 2019, the Company sold 571,120 shares for gross proceeds of $13.0 million at an average price of $22.78 for aggregate net proceeds of $12.9 million (net of transaction costs) since inception, with $1.8 million gross proceeds generated in the quarter ended May 31, 2019.

On September 27, 2018, the SBA issued a “green light” letter inviting Saratoga Investment to file a formal license application for a second SBIC license. If approved, the additional SBIC license would provide the Company with an incremental source of long-term capital by permitting Saratoga Investment to issue, subject to SBA approval, up to $175.0 million of additional SBA-guaranteed debentures in addition to the $150.0 million already approved under the Company’s first license. Receipt of a green light letter from the SBA does not assure an applicant that the SBA will ultimately issue an SBIC license and the Company has received no assurance or indication from the SBA that it will receive an additional SBIC license, or of the timeframe in which it would receive an additional license, should one ultimately be granted.

Dividend

On May 28, 2019, Saratoga Investment announced a dividend of $0.55 per share for the fiscal quarter ended May 31, 2019, payable on June 27, 2019, to all stockholders of record at the close of business on June 13, 2019. This increase is the nineteenth sequential increase to the Company’s quarterly dividends. On February 26, 2019, Saratoga Investment announced a dividend of $0.54 per share for the fiscal quarter ended February 28, 2019, paid on March 28, 2019, to all stockholders of record at the close of business on March 14, 2019. Total dividends declared for the fiscal years ended February 28, 2019 and 2018 were $2.10 per share and $1.94 per share, respectively.

Shareholders have the option to receive payment of the dividend in cash, or receive shares of common stock, pursuant to the Company’s DRIP.

Share Repurchase Plan

In fiscal year 2015, the Company announced the approval of an open market share repurchase plan that allows it to repurchase up to 200,000 shares of its common stock at prices below its NAV as reported in its then most recently published financial statements. During fiscal year 2017, the share repurchase plan was increased to 600,000 shares of common stock, and during fiscal years 2018 and 2019, this share repurchase plan was extended for another year at the same level of approval, currently through January 2020. As of May 31, 2019, Saratoga purchased 218,491 shares of common stock, at the average price of $16.87 for approximately $3.7 million pursuant to this repurchase plan.

Saratoga Investment made no purchases of common stock in the open market during the quarter ended May 31, 2019.

2020 Fiscal First Quarter Conference Call/Webcast Information

Saratoga Investment Corp.

Consolidated Statements of Operations

(unaudited)

Supplemental Information Regarding Adjusted Net Investment Income, Adjusted Net Investment Income Yield and Adjusted Net Investment Income per share

On a supplemental basis, Saratoga Investment provides information relating to adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share, which are non-GAAP measures. These measures are provided in addition to, but not as a substitute for, net investment income, net investment income yield and net investment income per share. Adjusted net investment income represents net investment income excluding any capital gains incentive fee expense or reversal attributable to unrealized gains. The management agreement with the Company’s advisor provides that a capital gains incentive fee is determined and paid annually with respect to cumulative realized capital gains (but not unrealized capital gains) to the extent such realized capital gains exceed realized and unrealized losses for such year. In addition, Saratoga Investment accrues, but do not pay, a capital gains incentive fee in connection with any unrealized capital appreciation, as appropriate. As such, Saratoga Investment believes that adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share is a useful indicator of operations exclusive of any capital gains incentive fee expense or reversal attributable to unrealized gains. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. The following table provides a reconciliation of net investment income to adjusted net investment income, net investment income yield to adjusted net investment income yield and net investment income per share to adjusted net investment income per share for the three months ended May 31, 2019, and May 31, 2018.